Gefen Family Office

Custom Wealth Management

We’re busy maintaining and growing your assets for generations, so you don’t have to deal with it.

Gefen Family Office

About Us

Since 2014, we have been providing Family Office services to about 120 wealthy families in Israel. Customized portfolios in diverse alternatives such as private equity, private debt, real estate and more.

Whether you want to preserve your legacy, plan for retirement, or diversify your investments, we’ll build a personalized strategy for you with the highest level of transparency and convenience

We develop and expand the value we provide around the personal needs of our customers on an ongoing and constant basis.So join us, we are building a prosperous future.

Six core principles that make up part of our worldview

These are some of the principles that accompany us. We believe that sticking to them allows for the peace of mind of our customers, knowing that their properties are best managed.

We strongly believe in active management of the asset portfolio. As the markets remain dynamic, existing financial solutions become more sophisticated and the needs of our clients change, from time to time, we recommend changes and improvements that can be made to the family investment portfolio. This is why we stay in regular contact and initiate new changes and recommendations in our account over the years, sometimes even through different generations.

We see all the assets, needs and desires of our clients as a single entity that consists of a very large number of different factors. Therefore, we believe that only through a holistic and comprehensive view of the family unit will it be possible to plan and manage in the best possible way.

The investment in a basic asset or a truly high-quality product is expected to pay off over time. At the same time, many investments can be affected in different ways by a large number of factors, in the short term. Therefore, we always look at our clients’ portfolios and investments from a long-term perspective and are not excited about some of the short-term fluctuations that may appear.

Each of our clients has a different character, scope and structure of assets, needs and desires. That’s why we believe in personalized financial planning, which consists of a unique strategy for each client and customized solutions.

The only thing that can always be said about the future is that the unknown part of it is necessarily greater than the known part of it. Also, the most important thing for most of all our clients is first of all, the preservation of the existing capital at their disposal. Therefore, we help our clients create a correct and high-quality distribution of their investment channels, thereby strengthening the stability of their portfolio and increasing its level of defensiveness.

The world of wealth management is constantly renewing and changing. New opportunities and products are born at all times. We believe that in order to provide the most professional service and to give our customers the necessary response, we should always make sure to be one of the leaders in the field, even if this requires us to get out of our comfort zone, examine and try new things.

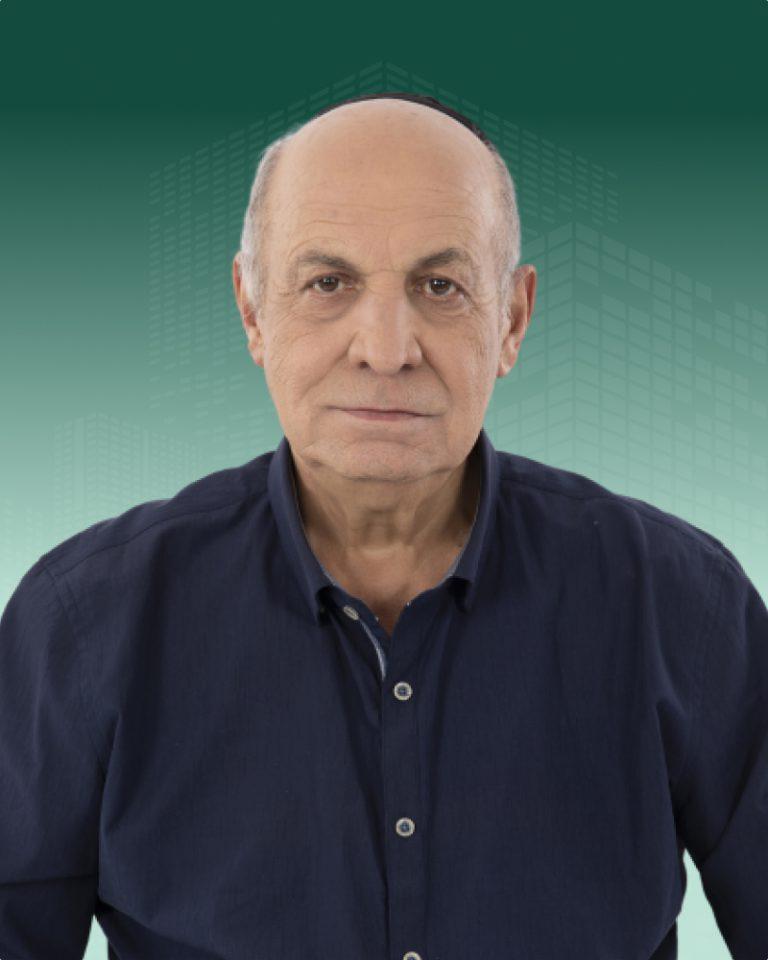

The Human Capital

We invite you to get to know our professional, dedicated and experienced team that makes up the company’s human capital:

Gefen Family Office offices

We will be happy to host you in one of our offices

Contact Us

If you are interested in maintaining and growing your family asset portfolio and in a professional and personal office, leave your details and we will get in touch as soon as possible

FAQ

Who is this family office?

The Family Office is a wealth management company serving particularly high-value individuals and families in the Gulf Cooperation Council countries since 2004. The family office operates in Bahrain and Saudi Arabia and manages tailored portfolio solutions worth $2 billion. In 2020, the family office moved its international subsidiaries in Hong Kong and New York to Petiole Asset Management (AG) in Zurich, which took on the asset management activities of the family office.

In what jurisdictions is the family office regulated?

The family office and Petiole Asset Management AG are subject to oversight by six regulators in Bahrain, the Cayman Islands, Hong Kong, Saudi Arabia, Switzerland, and the United States.

In what geographies can I invest?

The family office offers access to international investment strategies to balance our clients’ exposure to local markets. Taking advantage of our global footprint, we provide customers with access to key international markets and promotions around the world, including the U.S., Canada, China, Pan-Asia, Europe, and more.